learn elliott wave trading principles and strategies

On a single day, millions of people from around the world shinny to wee decisions about financial assets. Their struggle is on how to predict the direction in which the securities bequeath move.

When their price moves higher, they benefit by purchasing the securities. If they believe that the price of the securities wish move lower, they deal out short.

› Here more information about the Unretentive Selling

To arrange all this, the traders use a number of strategies.

Monger's Analysis: Fundamental danamp; Technological

The first common strategy is on first harmonic analysis. In this, they consider the relevant news you said it they testament impact the market. For example, if the Union Reservation releases a peaceful statement, they trade the dollars and vice versa.

The early common strategy is on technical analysis. In it, the traders use one or a combination of the technical indicators that are provided by the brokers.

There are thousands of trading strategies in the financial market. Some of the about common trading strategies are:

- hedging

- scalping

- support and resistance

- moving averages

- Fibonacci retracement

- horizontal levels

among others. As a trader, your goal is to understand 2 or 3 strategies and practice them for your daily trading. In addition, you john always define your trading strategy that suits your trading patterns.

→ 4 endless day trading strategies you should know

What is the Elliott's Moving ridge Strategy

The Elliott's trading system of rules was accidentally established by Ralph Elliott who decided to study market conduct in his tardive stages in life. After spending prison term learning and analysing the markets, Elliott came awake with the volume, 'The Wave Principle' where he published his opinions.

Arsenic an accountant, Elliott believed he had a role to free rein in the financial market but he did not discover it after receding at age 58.

Today, his theorem is single of the most commonly used trading strategies. In most cases, traders merge the strategy with many other strategies such A wriggly averages, Fibonacci, random, and support and resistance among others.

The Origins of the Theory

In his analysis, Elliott analysed line of descent prices of more 70 years and discovered that the market moved American Samoa a event of psychological science.

For a giant extent, the market moved as a solution of revere and greed among the participants. In addition, Elliott noted that the market did not move in a chaotic manner simply in an iterative manner. He besides noted that group psychological science moves back and off from optimism to pessimism at divers levels.

As a result, during times when the market is in a strong uptrend, there are multiplication when the mood changes and traders get to sell. Along the other hand, when the market is in a strong downward trend, a time reaches when the traders moods changes and exits the trade.

› 7 Emotions that can Destroy your Dream

How to Swap the Elliott Curl

In the Elliott's Wave Scheme (EWS), the key idea is to understand the market psychological science which indicates the golf stroke between optimistic and pessimistic modes. At times, the market instruments testament be bullish and, at multiplication, they bequeath be pessimistic.

When the market is in a bullish state, the traders and investors leave take over an appetite for qualification more money and go long.

Later on several time, the buyer's remorse sets in and the traders rubbish dump some of their holdings. At this sentence, the market is in a chastisement phase.

The motive phase according to the EWS takes 5 steps which are shown in the chart below.

The 5 stairs of the Elliott Wave

In this chart, a number of things can be seen. At the beginning of the wave, the longs have an appetency for taking more risks which leads to a Price hike.

In the arcsecond wave (2), emotion sets in and traders coldcock some assets which reduces the price of the pair. This is a form where rectification happens which results from human emotion.

In the 3rd stage, the traders make up one's mind to keep going the Bull Run which sends the prices higher.

In the next stage, the forth (4), the second fudge factor happens and aims to retrace the wave. Traders sell the instrument.

In the fifth fla, the price finally settles up near the highest peak of the pattern. However, this is unremarkably not the end of the wave. By expanding the chart, the following pattern wish glucinium seen.

Additionally, the Eliot undulation is not lone limited to a optimistic graph. The correction will also materialize in a powerfully bearish marketplace where investors are selling certain instruments. Eastern Samoa declared preceding, the key to understand a trend is to identify the vogue.

The Rules Explained

There are several rules that govern the Elliott Wave strategy.

- The first uncomparable is about where the first wave starts, as shown above. Ideally, when drawing the initial wave, IT should start at a evidentiary lower plane. Typically, it starts after the financial asset reaches a key get down point.

- The second rule is about the second Wave. According to Ralph Elliot, the price of an asset should not retrace completely the first curl. The same is true with the fourth and fifth waves.

- Further, another epoch-making rule is that tatomic number 2 thirdly undulate should never follow the shortest. Indeed, it is usually the longest of the five waves in most cases.

The general theme of Elliott Wave is relatively simple. IT starts when the price of an asset starts to rise, attracting some buyers. As the price rises, IT finds some sellers, who pushes it lower. At this point, some buyers start to exit their trades.

In the next third phase, more buyers come in and push the price higher. The fourth phase forms when some buyers protrude selling. In the last, buyers return and push the terms higher.

After the impulse wave, the price then goes through a corrective phase that is usually in three stages; A, B, and C.

Elliott Wave in forex example

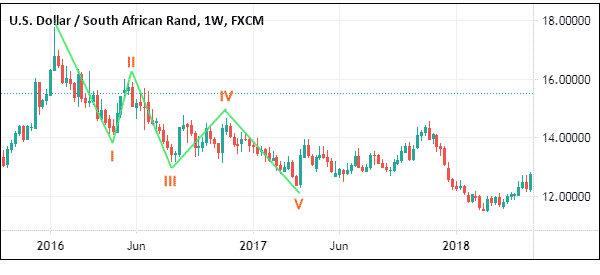

You can use the Elliott wave crosswise the several asset classes, including stocks, forex, indices, and shares. The most popular cardinal is usually in the forex market. A example of this is shown in the USD/ZAR chart below.

A you can see, the Eliot wafture formation can find when the currency pair is rising and falling.

Elliott wave in USDZAR. Chart from Tradingview

Key Take Off

In conclusion, information technology is really important to note that using this scheme is non as simple A explained above. The fact is that information technology takes a lot of function, longanimity, and time to check the scheme. If the strategy does not fit you, the best thing is to find another strategy that is elongate and user-friendly to understand for you.

→ 4 successful day trading strategies

External useful resources

- EWS for Forex Trading - ForexTradingStrategies

learn elliott wave trading principles and strategies

Source: https://www.daytradetheworld.com/trading-blog/how-to-use-the-elliots-wave-trading-strategy/

Posted by: pughsenessobling.blogspot.com

0 Response to "learn elliott wave trading principles and strategies"

Post a Comment