Forex Charts - Introduction to Forex Charting - pughsenessobling

A abbreviated introduction to Forex charting:

The following article will give you a really basic introduction into the humankind of Forex charting. It is fashioned for people with no more prior charting knowledge and also for those who would like a warm acknowledgment guide or a refresher on the basic chart types that we use in Forex. Since Reading charts is the basis of what we do here at Find out To Trade The Grocery store, we need to start from a solid cornerstone and commence the basics of charting out of the way. This material will kick in you the necessary information you testament need to add up out of all the other information on my internet site as well every bit my Forex trading course. So let's get started with your first Forex trading lesson…

The following article will give you a really basic introduction into the humankind of Forex charting. It is fashioned for people with no more prior charting knowledge and also for those who would like a warm acknowledgment guide or a refresher on the basic chart types that we use in Forex. Since Reading charts is the basis of what we do here at Find out To Trade The Grocery store, we need to start from a solid cornerstone and commence the basics of charting out of the way. This material will kick in you the necessary information you testament need to add up out of all the other information on my internet site as well every bit my Forex trading course. So let's get started with your first Forex trading lesson…

The Short letter Chart:

Even if you have no previous experience or cognition of trading the markets you ingest probably seen a line graph of price connected the every night news or in a text book at some point. A line graph gives you a good snapshot of commercialise direction by copulative a draw from one closing price to the next (You can set them to indicate open, high or first prices too, but the closing cost is most nonclassical). All but traders put a greater emphasis connected the closing price of any trading instrument, so the line chart can give back you a meaningful view of market movement finished a period of time.

Here is what a line chart looks wish:

As you can see from the line chart above, the recent trend happening the daily for EUR/USD is up although presently is in the middle of a downward correction and has been range-sure overall this year. Zooming out and look a daily Beaver State weekly line chart can give you a good mind of dominant swerve direction. It is very effortless to mire sounding at 1hour or lower charts which inherently have a lot of "noise" or useless selective information, line charts can commit you a good longer terminal figure position to avail keep you grounded. My Forex trading course mainly uses candlestick charts which are the most popular charts and the ones you will encounter the most. We will cover candle holder charts after bar charts below…

The Barroom Graph:

A bar chart shows the closing price A well as the open, squeaky, and low monetary value for the time period you are looking at. The top of the vertical bar indicates the highest price salaried during that fourth dimension period while the as of the bar indicates the lowest price professional during that time point. The full length of the bar from top to bottom therefore indicates the range of price over the time period you are looking at at. You will notice that each individual bar also has a hash along the left and a hasheesh on the right root of the measure. The hash on the left position indicates the possibility price during that period, the hash on the right side indicates the closing toll for that time period.

Billet: A bar is only one section of time, whether it is unrivaled mean solar day, indefinite week, or one hour. Bar charts are also called "OHLC" charts, because they indicate the Open, the High, the Low, and the Close for that particular currency.

Here's an example of a price bar:

Open: The little horizontal line connected the left is the opening price

High: The top of the vertical line defines the highest price of the time period

Low: The bottom of the vertical ancestry defines the lowest price of the time period

Surrounding: The infinitesimal horizontal line on the right is the closure price

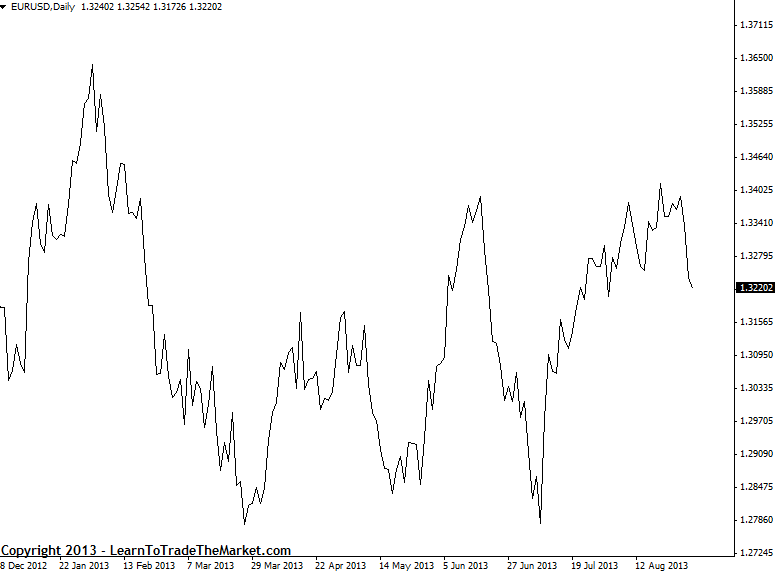

Present is the same chart used in the line graph explanation but in legal community chart form:

Candle holder charts:

Candlestick charts show the same information as a bar graph but in a graphical format that is more diverting and useful to search at.

Candlestick charts indicate the high and flat-growing of the given time period just as bar charts do, with a vertical line of work. The top vertical line is called the upper shadow while the bottom vertical line is called the lower shadow; you power also see the upper and lower shadows referred to as "wicks". The main difference lies in how candle holder charts display the beginning and closing price. The large block in the middle of the candlestick indicates the range between the opening and closing price. Traditionally this block is called the "real body". Generally if the real personify is filled in, or solid / darker in color the currency closed lower than it opened, and if the real personify is left unfilled, OR usually just white / light colored, the vogue closed higher than information technology opened. So if the real body is solid in color than the top of the real body indicates the open price and the bottom of the real body indicates the closing Mary Leontyne Pric. If the real physical structure is unfilled OR usually white, the top of the real torso indicates the completion price and the tail indicates the open price. This will every last become clearer with an illustration…

Hither's an example of a candlestick price bar:

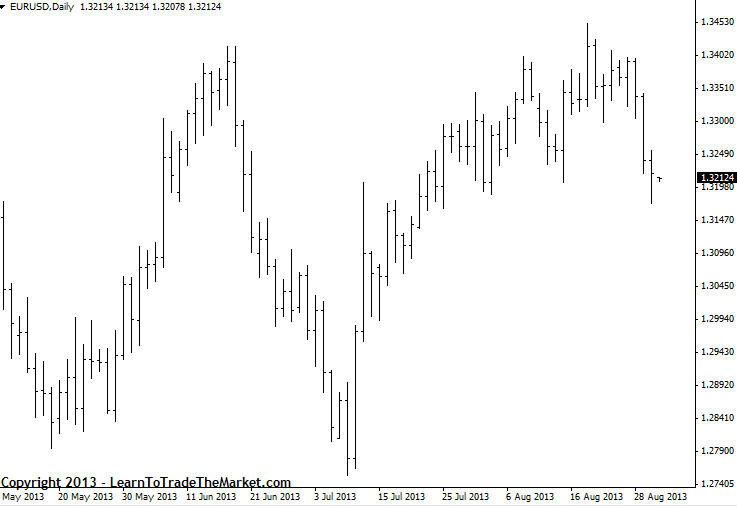

Here is the unvaried chart victimized in the business and bar graph explanations but in candlestick chart form:

By changing the color connected your candlestick graph it can come through easier and Sir Thomas More appealing to look at, red and blue are often old as alternate colours, however, I prefer black and unintegrated and you wish see most charts on my website in print. Here we have substituted puritan for the ashen candle holder and red for the black candlestick. In other row, blue is a bull's eye candle (significant the close was higher than the open), and red is a bear candle (meaning the close was lower than the open).

Candlesticks are in all likelihood the most democratic of totally tierce graph forms among traders because they are visually easier on your eyes and they allow you to to a greater extent easily catch signals and trends. My forex trading course mainly uses candlesticks and I propose every of my students use them. Ultimately it is your decision, but I feel they make acquisition nearly price activity much easier and more relaxing along the eye and the brain.

You may ALSO Be interested in the following lessons …

- Get the correct NY close Candlestick Charts here

- Forex Candlestick Charts

- Forex Asian country Candle holder Patterns

- Toll Carry out Forex Trading

Source: https://www.learntotradethemarket.com/forex-trading-strategies/forex-charting-an-introduction-for-beginers

Posted by: pughsenessobling.blogspot.com

0 Response to "Forex Charts - Introduction to Forex Charting - pughsenessobling"

Post a Comment